Simplifying payment process is key to online commerce, prompting the development of dedicated payment collection solutions such as Kevin.

Since the emergence of e-commerce, people have had to adjust their shopping and purchasing habits accordingly. From bartering goods for money via postal delivery services to sending wired funds by telegraph, payment has changed immensely over time.

Credit cards

Credit cards have long been one of the primary means of payment in online commerce, offering consumers numerous advantages such as interest-free financing and rewards programs. But when selecting a provider, consumers must bear several things in mind.

At first, credit cards were charge cards that had to be repaid each month in full. That changed in the late 1950s with Diner’s Club offering its plastic green card and BankAmericard creating what later became VISA as national licensed programs for credit cards.

IBM created magnetic stripe technology during the 1960s that allowed merchants to verify credit cards at merchant points of sale, marking an important step toward modern electronic payment systems. Meanwhile, some countries developed their own credit card networks such as Barclaycard in the UK and Bankcard in Australia which later merged into Visa and Mastercard networks.

Debit cards

Debit cards have become an increasingly popular way of paying online and in stores. While debit cards work similar to credit cards, they’re linked directly to your bank account instead and come with lower fees than their counterparts. Programmable PINs provide another layer of security.

John Biggins of Brooklyn created the Charg-It card as the inaugural closed-loop credit card in 1946. Utilizing his bank as the intermediary for transactions, this allowed him to buy items now and pay them back later.

The card industry has seen many shifts and it can be hard to predict their direction going forward, yet some broad trends can be easily identifiable. One such trend is how credit card issuers are increasingly shifting away from relying on limited data points when reviewing credit applications in favor of building up an overall picture of each potential customer – this approach helps reduce fraud activity while simultaneously increasing user security.

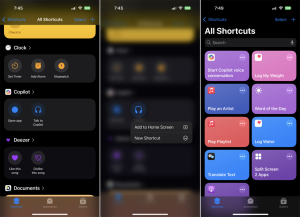

Mobile payments

The mobile payments market is evolving at a remarkable rate. New entrants and established players alike are upending this industry, including payment aggregators such as PayPal, Google and Apple as well as smartphone multinationals with their own mobile payment solutions. This trend is expected to continue for some time.

Mobile payments refer to point-of-sale purchases, bill payments and money transfers made using a mobile phone or app. They may use money from credit/debit cards, prepay accounts or even directly stored funds on the phone itself as payment sources.

Consumer priorities when selecting their provider vary by country, but most prioritize factors like trustworthiness and convenience when making their selection. This gives mobile providers an opportunity to gain market share among current account holders; however, to do so they will first need to meet consumer needs by investing significantly in technology while developing an in-depth knowledge of consumer journeys.

E-commerce

E-commerce (electronic commerce) refers to the purchase and sale of goods and services over computer networks. E-commerce has revolutionized many aspects of life from shopping for personal needs to global supply chains.

E-commerce has experienced numerous developments over the years. Perhaps two of its most impactful advancements include mobile device-based purchasing of products and services as well as chatbots which allow users to complete transactions through voice-based and textual means. Furthermore, purchases made online are always available whereas brick-and-mortar stores may have limited opening hours.

E-commerce’s history can be traced to the advent of computers and the Internet. The Boston Computer Exchange launched as the inaugural e-commerce website in 1982. Soon thereafter, Michael Aldrich developed electronic shopping – which allowed consumers to connect directly to transaction processing computers using television and telephone lines – leading to massive consumer marketplaces like Amazon as well as business-to-business markets like Alibaba; thus significantly decreasing intermediary roles within traditional markets.

More Stories

Beyond the Noise: How Micro-Communities and Niche Platforms Forge Real Industry Connections

Privacy-first networking: Secure alternatives to mainstream platforms

Beyond the Connection: Gamification Techniques to Supercharge Your Networking App